Where We Stand on Cotton

The Kingpins show and the Transformers Foundation believe all cotton fiber should be transparent and have its input data, carbon footprint and water usage in the public domain, verified by an independent third party.

Sustainability begins for us when there is data to prove the starting point. Transparency is therefore critical.

We believe all farmers in developed countries such as Europe Union member countries, Turkey, Brazil, Australia and the United States should be transparent from seed to gin. In developing countries — where multiple cotton gin operators often take in cotton from thousands of farmers — cotton should be transparent from gin out.

We are neutral on how a company tracks its supply chain — be it a sustainability program such as Fairtrade or the Organic Cotton Accelerator or an organization like Supima, which certifies the cotton gown by its members. We believe in responsibly grown cotton — whether it is organic, transitional (cotton produced while a farm is transitioning from conventional to organic), GMO or non GMO. However, we need data with clear transparency to back up claims of sustainability.

For example:

-

- How much cotton is grown on how many hectares/acres?

-

- Where is it grown and under what conditions?

-

- Who was the farmer?

-

- Who was the gin?

-

- What were the inputs and water usage?

-

- What pesticides/herbicides were used, including the pesticides, industrial chemicals and by-products identified by the Stockholm Convention on Persistent Organic Pollutants?

-

- Is the data independently verified?

Our message to brands and retailers is this:

Let’s make cotton less complicated and more straightforward.

The only way to do that is to make transparency, data and third-party authentication the essence of any sustainability claims made by our industry. All products sold as sustainable cotton must be supported and verifiable by trusted data and third-party assurance regardless of the program. And we need to be transparent on our measurement tools, protocols and certifications.

Cotton by the Numbers

To reach our conclusion, we looked at statistical information from the International Cotton Advisory Committee, the association for countries that produce, consume and trade cotton. The 80-year-old organization, which is universally respected as the gatekeeper for global cotton data, gathers information about cotton production and consumption from all cotton-producing countries across the globe.

For our research, we looked at ICAC data from the top 15 cotton-producing countries over a five-year period from the 2011/2012 season through the 2016/2017 season. In addition to global cotton production data, ICAC also gathers statistics on global organic cotton production from the Textile Exchange and the International Federation of Organic Agriculture Movements (IFOAM). ICAC also has data from organizations such as the Better Cotton Initiative, Fairtrade, e3 and Cotton made in Africa. ICAC refers to these organizations as “Cotton Identity Programs” or CIPs, although not all programs breakdown their data by country. ICAC’s data is updated as countries and CIPs provide new figures.

Not all information is updated at the same time and, for that reason, we looked at total reported cotton production and organic cotton production between 2011 and 2015, as well as estimates for 2016. ICAC has additional information about estimated cotton production through 2018 and forecasts through the 2019/2020 growing season, but the same information for organic cotton during that period is not yet available.

Breaking Down the Differences in Cotton

There are a number of different cotton types, including:

Conventional cotton, which is grown using synthetic agrichemicals such as fertilizers, herbicides, insecticides and defoliants.

Transitional cotton, which is grown on a farm that is transitioning between conventional and organic farming methods. Transitional cotton is grown without synthetic chemical fertilizers or pesticides, but the soil cannot be certified organic until it has been chemical-free for three years.

Upland cotton, or Gossypium hirsutum, has short- to medium-staple fibers. ELS, or extra-long staple cotton includes a number of long-staple varieties, such as Pima, Sea Island, Indian Suvin and Egyptian Giza 45. Supima is the branded version of American Pima cotton.

Organic cotton is certified to be grown following organic agricultural standards. It uses natural processes rather than artificial inputs, such as agrichemicals or GMO (genetically modified organisms).

GMO cotton is grown from seeds that have been genetically modified to resist pests. Some GMO seeds have a genetic marker that allows companies to trace the cotton throughout the supply chain.

Organic Cotton and the Global Perspective

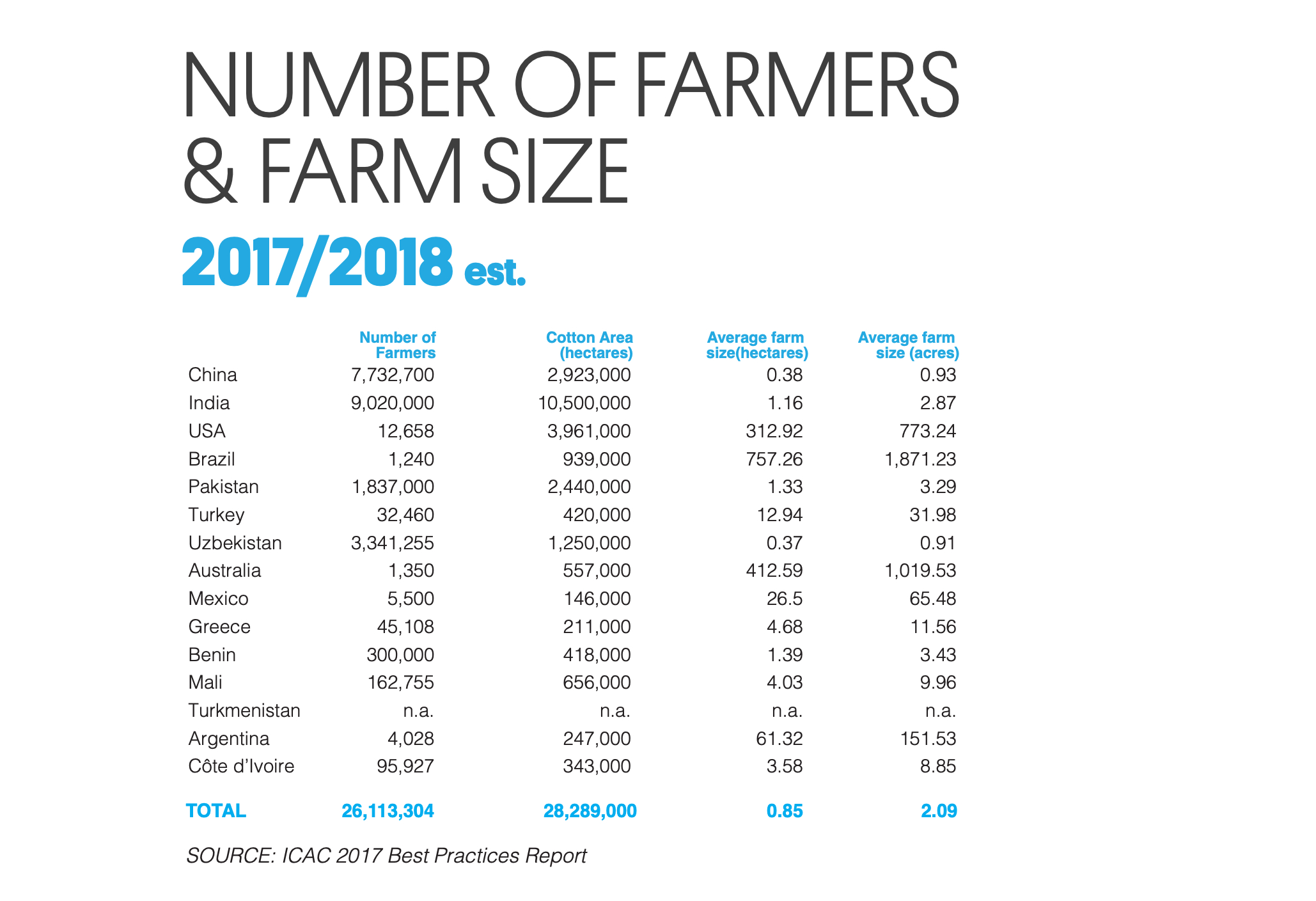

Organic cotton production makes up just 0.4 percent of the global cotton market, according to ICAC, which reported 27 million metric tons of cotton produced worldwide in the 2016/2017 season compared to 117,524 metric tons of organic cotton produced during the same period.

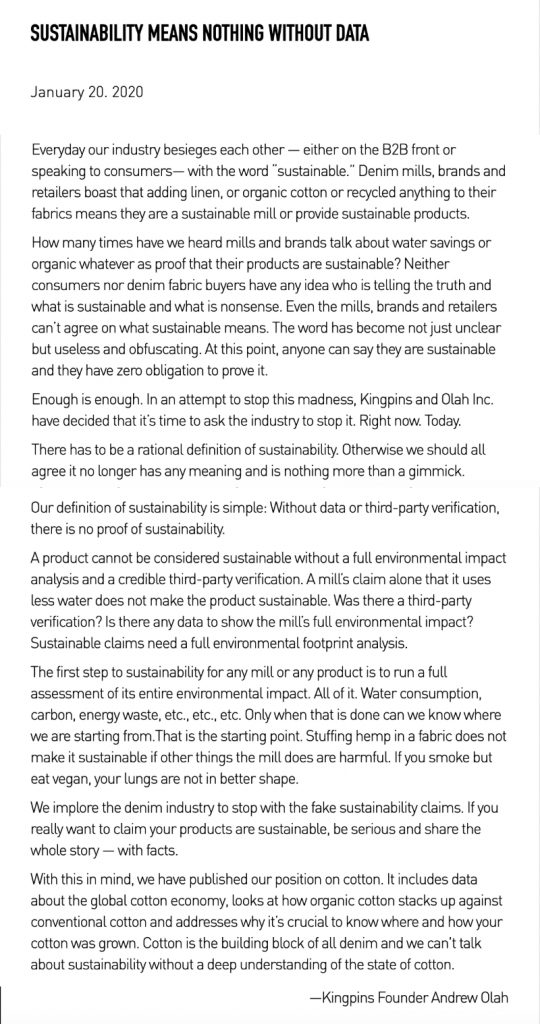

There were about 220,000 farmers producing organic cotton that year, according to the Textile Exchange’s 2017 Organic Cotton Market Report, while ICAC estimates the total number of farmers producing cotton worldwide at about 26 million, according to ICAC’s Best Cotton Practices Report.

The U.S., China and India are consistently the top producers of cotton. But cotton is grown on nearly every continent and other top-producing countries include Pakistan, Brazil, Australia, Uzbekistan, Turkey, Turkmenistan, Burkina Faso, Mali, Greece, Argentina and Benin.

Organic cotton production worldwide has fluctuated during the five-year period between 2011/12 and 2016/17, as has the overall cotton market. Organic cotton production increased nearly 9 percent in 2016/17 over the previous season, while the global cotton market was up more than 7 percent in the same period. The overall cotton market and organic cotton production declined over the course of the five-year-period, with global cotton production dropping 17 percent and organic cotton production dropping 15 percent.

In short, while the organic cotton market has increased and decreased over the years, its share of the global cotton market has remained consistent, shifting between roughly 0.4 percent and 0.5 percent between the 2011/2012 and 2016/17 seasons.

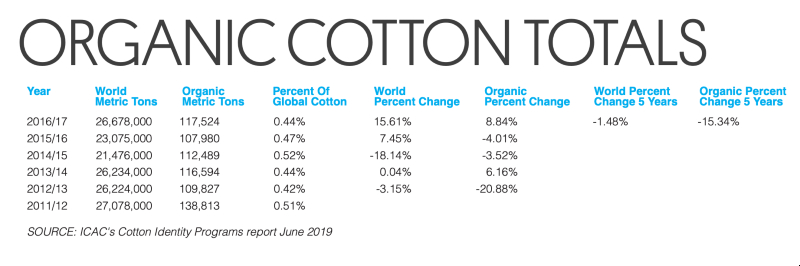

It should come as little surprise that the top cotton producers — India, China and the U.S. — are also the top producers of organic cotton.

The largest percentage of organic cultivation compared to overall cotton production can be found in India and Turkey, with between 1 percent and nearly 2 percent organic cotton produced during our 5-year survey.

The percentage of organic cotton production in Mali and Burkina Faso is also higher than most other countries, at 0.16 percent to 0.33 percent, but both African nations, while consistently among the top 15 cotton producers in the world, produce far less cotton than India or Turkey.

Cotton: Less Challenging Than You Think

Cotton fiber and fabric is loved by consumers for its breathability, soft touch and strength. Like any agricultural product, cotton requires water, it’s vulnerable to insects and its crops need to be rotated to replenish nitrogen in the soil.

Drip irrigation has made cotton cultivation more precise and reduced the amount of water lost to runoff and evaporation. Similarly, farmers are using GPS to collect field and yield information.

But cotton is often grown in countries with low water available per capita, such as Pakistan, Uzbekistan and Turkmenistan. It is often grown by small farmers with limited access to water-conservation systems such as drip irrigation or GPS.

Further, a country’s cotton industry is not monolithic. In India, only 33.6 percent of cotton is grown using irrigation, according to ICAC, leaving the majority (66.4 percent) of cotton farmers dependent on the rain.

Genetic modification has produced cotton that is resistant to insects. For example, Bt-cotton protects crops from damage from bollworms and HT-cotton protects them from herbicides. GMO cotton has not been developed to produce higher yields, but genetic modification can protect yields.

However, there is social resistance to the cultivation of genetically modified agricultural crops in many regions, including the European Union. Among the top 15 cotton producers, Turkey and Greece ban the cultivation of GMO cotton.

Both countries are much smaller than the top three cotton-producing countries, and therefore produce less cotton than the U.S., China and India. But their yields are high and both Turkey and Greece are key cotton resources for Europe.

Turkey’s production estimate for 2016/17 was just over 700,000 metric tons of cotton (and nearly 8,000 metric tons of organic cotton), according to ICAC, while Greece estimated its cotton output at 213,000 metric tons that season, of which 0.4 percent was organic. ICAC data indicates that the yields of Turkey was about about 1674 Kg/ha during the 2016/17 season, while the Greece harvest yield was about 1000 Kg/ha, which rank the two nations’ cotton production at 4th and 9th place in the world, respectively.

Eye on Supply (Chain)

Organic certification requires a detailed look at the supply chain, but for the vast majority of the cotton supply, this information is not tracked. It’s a complicated task, tracing the cotton supply chain. As mentioned earlier, a single gin might process cotton from a huge number of farmers. Spinners, mills and retailers source cotton from a wide range of suppliers. Further, ginned cotton can pass through many hands, as cotton merchants buy, sell and store bales before they reach the spinners and mills.

Country of origin can be determined through import documentation, but imported yarn or fabric might not necessarily identify the fiber’s point of origin. And gathering additional information requires a commitment to transparency and the tools to track cotton back to seed.

Why is it necessary to know where cotton came from? It’s clearly important for specialty fibers, such as organic cotton or Supima branded cotton — particularly if a company is asking for a premium price.

There are other reasons a company would want to know the provenance of its raw materials — and some of these reasons are closely tied to the company’s stated values.

Would a brand want to buy from a farm — whether in the USA or Spain or Turkey — if the farmer was breaking the law? Or from one that was conducting business in a way that conflicted with the brand’s principles?

How can a company be assured that something is not illegal or damaging to people or the environment if they don’t know where it’s from and how was grown?

Consumers are beginning to question where and how the products they buy are made. They want assurances that the products they buy are not grown, made or processed in a way that exploits people, exhausts natural resources or harms the environment.

Companies that track and monitor their cotton supply chain are, in effect, insuring against future damage to their brand if human or ecological abuses are discovered to have occurred somewhere along the chain.

Companies that have a corporate social responsibility policy in place but don’t monitor their raw materials prior to the mill or spinner are taking, at best, a partial look at the supply chain and leaving themselves vulnerable to negative press, brand damage, lost sales and potential litigation.

Cotton cultivation’s history is entwined with slavery but the issue of forced labor in the cotton industry continues today.

Forced labor has been used to grow and harvest cotton in Uzbekistan and Turkmenistan, according to the International Labor Organization and Human Rights Watch. Uzbekistan banned the use of child labor in 2012 and has been declared child-labor and forced-labor free by the ILO.

The Responsible Sourcing Network runs an outreach campaign asking retailers and brands to pledge to eliminate cotton grown using forced labor, and continues to target Uzbek, as well as cotton grown in Turkmenistan. ICAC recommends Turkmenistan join the ICAC, which will help its cotton industry eliminate child labor and forced labor using Uzbekistan as the model.

The BBC reported in November that members of China’s Uighur minority have been enlisted as forced labor working in the cotton industry in China’s Xinjiang region. The BBC story cited an October report, “Connecting the Dots in Xinjiang: Forced Labor, Forced Assimilation, and Western Supply Chains,” from the Center for Strategic & International Studies.

According to the CSIS report, the vast majority — 84 percent in 2018 — of Chinese cotton is produced in Xinjiang. The report says that forced or “coerced” labor is tied to China’s effort to lift its rural population out of poverty by building a workforce of 1 million in Xianjiang’s textile and garment industry by 2023.

The U.S. Department of Labor also lists China among 18 countries suspected of using either forced labor or underage workers (or both) in the production of cotton.

Supply Chain Transparency

We take no position regarding identity and certification programs for cotton. There are many international organizations devoted to ensuring supply chain transparency, including several that have a focus on cotton.

Better Cotton Initiative (bettercotton.org) The Better Cotton Initiative offers training in sustainable farming practices to more than 2 million cotton farmers in 21 countries. BCI farmers produced more than 5 million metric tons of BCI cotton in 2017/18, which made up 19 percent of the global cotton supply, according to the organization, based in Geneva, Switzerland and London.

CottonConnect (cottonconnect.org) CottonConnect is a social enterprise founded to create a transparent supply chain between brands and retailers and smallhold farmers in India, Pakistan and China. The London-based organization provides training in agro-economic practices to transition to more sustainable cotton farming.

Cotton Leads (cottonleads.org) Cotton Leads is a joint initiative between cotton producers in Australia and the United States to promote sustainable improvements in both countries’ cotton industries through investment and implementation of best practices and national infrastructures. Cotton Australia and The Cotton Foundation are founding organizations of Cotton Leads and supporting organizations include Australian Cotton Shippers Association, National Cotton Council of America, Cotton Council International and Cotton Inc.

Cotton made in Africa (www.cottonmadeinafrica.org/en) The Cotton made in Africa initiative was created to help the 3.4 million small cotton farmers in Sub-Saharan Africa to improve economic living conditions for them and their workers by identifying efficient and environmentally friendly practices and creating an international alliance of textile companies that purchase CmiA raw materials

e3 (agriculture.basf.com/us/en/Crop-Protection/e3-Cotton.html) German chemical giant BASF’s supply chain tracking program, e3, starts with FiberMax and Stoneville branded cotton seed, which allows end customers to trace cotton from farmer to gin to merchant, mill and retailer. The cotton is fully traceable and certified through independent audits of the farmers’ environmental and social practices such as water efficiency, pesticide usage and reduction of greenhouse gas.

Fairtrade International (www.fairtrade.net) Fairtrade International, based in Bonn, Germany, was founded to connect consumers with disadvantaged producers and promote fairer trading conditions through its certification process and labeling of members’ products.

International Federation of Organic Agriculture Movements (www.ifoam.bio) The International Federation of Organic Agriculture Movements (IFOAM) is a Bonn, Germany-based organization founded to promote sustainable, organic agriculture and connect the value chain from farm to final consumer. The group has more than 750 members in more than 127 countries.

Organic Cotton Accelerator (www.organiccottonaccelerator.org) The Organic Cotton Accelerator is an Amsterdam-based group committed to creating a prosperous organic cotton industry that connected all parts of the supply chain, from farmer to final consumer through industry-wide collaboration and shared knowledge.

myBMP (www.mybmp.com.au) The myBMP program was founded to ensure the Australian cotton industry uses best management practices through self-assessment mechanisms, practical tools and auditing processes to help growers improve on-farm production. The organization targets biosecurity for control of pests and diseases; encourages the use of energy-efficient inputs; helps farmers provide safe and compliant workplaces for employees and contractors; and provides educational tools to maintain and improve soil fertility and water management.

Responsible Brazil Cotton (www.abrapa.com.br/EN-US) The Responsible Brazilian Cotton program (ABR) seeks to promote the image of Brazilian cotton as a sustainable resource by encouraging social, environmental and economic practices among the country’s cotton farmers.

Responsible Sourcing Network (www.sourcingnetwork.org) The Responsible Sourcing Network is part of the As You Sow nonprofit organization, which was founded to end human rights abuses and forced labor in the global manufacturing supply chain, including in the cultivation of cotton. The organization has campaigns urging brands and retailers to eliminate cotton grown in Uzbekistan and Turkmenistan from their supply chains because of reports about forced labor in both countries’ cotton industries. Today 312 companies and organizations have signed on to the Uzbek cotton pledge and 70 have signed the Turkmen cotton pledge.

Supima (supima.com) Supima is a branded, U.S.-made extra-long staple Pima cotton. The company runs a licensing program for all components of the apparel and home decor supply chain including spinners, weavers, knitters, manufacturers, brands and retailers to ensure that their products are made with Pima cotton grown by certified U.S. farmers.

Textile Exchange (textileexchange.org) Texas-headquartered Textile Exchange works with its global community of members to establish standards and best practices in farming, materials, processing, traceability and product end-of-life with a mission to reduce the impact of the textile industry on the world’s environmental resources and its population. U.S.

Cotton Trust Protocol (trustuscotton.org) The Sustainability Task Force was created in 2017 to research methods to help the U.S. cotton industry, including producers and textile manufacturers, develop steps to implement and communicate its sustainability steps. The U.S. Cotton Trust Protocol is the program to oversee and validate those steps by setting national environmental goals for soil carbon, land use, greenhouse gas emissions, soil loss per acre, water use and energy use. The organization has set 2025 as the deadline for achieving those goals.